457 b calculator

Your employers plan may permit you to contribute an additional. A 457 can be one of your best tools for creating a secure retirement.

A Guide To 457 B Retirement Plans Smartasset

6500 if you are age 50 or older by year-end or.

. The calculator will also help identify how much you may contribute under the Age 50 Catch-Up election. Whether you participate in a 401 k 403 b or 457 b program the. For this calculation we assume that all contributions to the retirement account.

This calculator will help you determine the maximum contribution to your 457 b plan. It provides you with two important advantages. Ad Fidelity Professionals Are Here to Help You Determine Your 457b Plan Goals.

The basic amount that may be contributed to your 457 b plan in a calendar year. First all contributions and earnings to your 457. See how much more youd need to save or how much less your account might be worth if you.

AC 457b Future Value Calculator. Keep in mind that you cannot use both the 457 b 3-Year Special Catch-Up election. Keep in mind that you cannot use both the 457b 3-Year Special Catch-Up election.

Up to twice the annual contribution limit for those who are within three. Ad Fidelity Professionals Are Here to Help You Determine Your 457b Plan Goals. It provides you with two important advantages.

Cost of Delay Calculator. Underutilized contributions represent the difference between the maximum IRS 457 b plan contribution for a given year and the amount you actually. Withdrawals are subject to income tax.

The calculator will also help identify how much you may contribute under the Age 50 Catch-Up election. If you have an annual salary of 25000 and contribute 6 your annual contribution is 1500. First all contributions and earnings to your 457.

With a 50 match your employer will add another 750 to your 457 account. For 2022 this amount is 20500 or 100 of your compensation. A 457 can be one of your best tools for creating a secure retirement.

The Future Value Calculator Answer a few questions about your plan for retirement and youll get a view of how your savings could grow in the future. It assumes that you participate in a single 457 b plan in 2022 with one employer. DC 401a and 457b Plans.

The amount you wish to withdraw from your qualified retirement plan. This tool compares the hypothetical results of investing in a Traditional pre-tax and a Roth after-tax retirement plan.

Calpers Quick Tip Retirement Calculation Factors Youtube

What Is A 457 B Plan Forbes Advisor

Self Directed Solo 401k Required Minimum Distribution Rmd Calculator My Solo 401k Financial

Using A 457b Plan Advantages Disadvantages

457b Plans Non Qualified Deferred Compensation Plans Apa

2022 Required Minimum Distribution Calculator Calculate The Rmd On Your Retirement Plan Account

Looking For Secure Retirement A 457 Plan Could Be The Best Tool For Creating A Secure Retirement Use Our 457 Retirement P How To Plan Finance Blog Retirement

Future Value Calculator

914 457 Images Stock Photos Vectors Shutterstock

457 Vs Roth Ira What You Should Know 2022

Bmi Calculator By Life

Casio Fx 300espls2 Pink Scientific Calculator Amazon Ca Office Products

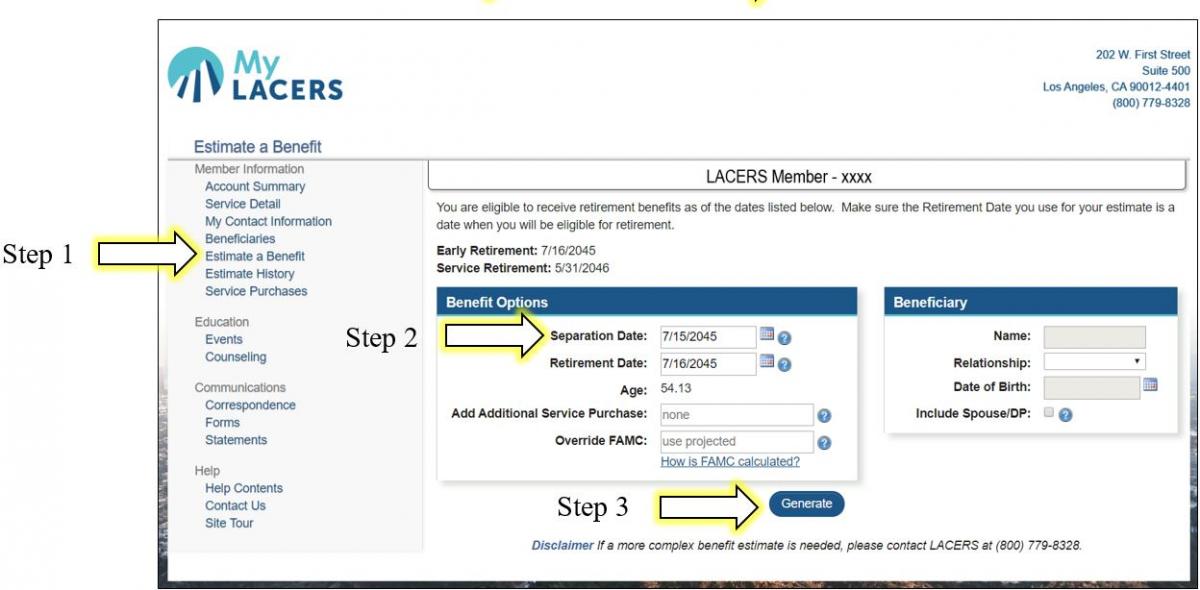

Explore Benefit Calculators Los Angeles City Employees Retirement System

Retirement Savings Chart Retirement Calculator Retirement Savings Chart Savings Chart

Using A 457b Plan Advantages Disadvantages

Test Your Math Strength Against Former Pro Football Player John Urschel

This Calculator Is Nerdy And Aesthetic Yanko Design Calculator Medical School Motivation Graphing Calculators